About This App

-

Category

Shopping

-

Installs

5,000,000+

-

Content Rating

Rated for 3+

-

Developer Email

-

Privacy Policy

https://www.affirm.com/privacy/

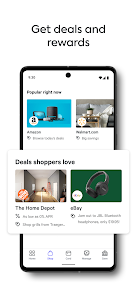

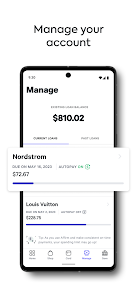

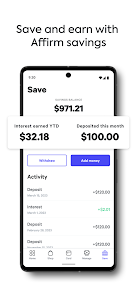

Screenshots

App Overview

Affirm is a finance app that lets you split your purchases into manageable payments over time. You can use it to shop online or in-store at thousands of popular retailers. Instead of using a credit card, you see the total cost upfront with no hidden fees, so you know exactly what you'll pay. The app makes it easy to apply for a loan at checkout, get an instant decision, and choose a payment plan that fits your budget. You can download the Affirm app directly from the Google Play Store to start using it right away. If the Google Play Store isn't available on your device, you can get the latest APK file from our website by clicking the download button.

Using the app is straightforward. When you're ready to buy something, just select Affirm as your payment method. You'll enter a few details, and the app will show you your loan options in seconds. You can pick a plan with bi-weekly or monthly payments. The app also helps you track all your upcoming payments and manage your spending in one place. It sends you reminders so you never miss a due date. This makes budgeting for bigger purchases much simpler and more transparent than traditional credit.

To install Affirm, simply go to the Google Play Store, search for "Affirm," and tap install. Once downloaded, you can create an account and link a payment method. The app will guide you through the setup process. Having the app on your phone means you can use Affirm for in-app purchases, online shopping, and even some in-store transactions by generating a virtual card. It's a convenient tool for financing things you need without the stress of compounding interest or surprise fees.

Similar Apps Comparison

Compared to other "buy now, pay later" apps like Afterpay or Klarna, Affirm has some clear advantages. A major benefit is its transparency; Affirm shows you the total interest you'll pay before you commit, and it never charges late fees. This is different from some competitors where late fees can add up quickly. Affirm also offers longer payment terms on certain purchases, sometimes up to 60 months for larger items, which can make payments very low. However, a disadvantage is that Affirm performs a soft credit check when you apply, which might not appeal to users who are very credit-shy, whereas some other services do not check credit at all.

Another competitor is credit cards, but Affirm is often simpler for single purchases. With a credit card, you might carry a balance with high interest. Affirm gives you a fixed plan with a set end date. The downside compared to a credit card is flexibility; you generally can't use Affirm everywhere, only at participating merchants. Also, while Affirm helps build credit with some loans, not all payment activity is reported to credit bureaus, so its impact on your credit score can be less consistent than using a credit card responsibly. For targeted, fee-free financing, Affirm is a strong choice.

User Feedback

BudgetBuilder: Love how clear everything is! Bought a new mattress and knew the exact total from the start. The payments come out automatically, so I don't forget. It's so much less stressful than putting it on a credit card and worrying about interest.

SmartShopper_Jen: I use this for almost all my online shopping now. The app is super fast at checkout—just a few taps and I'm done. I wish more physical stores accepted it, but for online, it's my go-to payment method. Makes budgeting a breeze.

NoFeeFanatic: Finally, a service that doesn't punish you for being a day late. No late fees is a huge win for me. The interest rates are fair and shown upfront. My only gripe is I can't use it at my favorite local boutique yet.

FAQs About This App

Q1: Does using Affirm affect my credit score?

A1: Applying for an Affirm loan may involve a soft credit check, which doesn't hurt your score. For some longer-term loans, your payment history might be reported to credit bureaus, which can help build your credit if you pay on time.

Q2: Where can I shop with Affirm?

A2: You can use Affirm at thousands of online stores and some physical retailers. Look for the Affirm logo at checkout online, or use the app to generate a one-time virtual card for in-store purchases where accepted.

Q3: What happens if I miss a payment?

A3: Affirm does not charge late fees. However, missing payments can prevent you from using Affirm for future purchases, and for certain loans, it may be reported to credit bureaus, which could negatively impact your credit score.

Recommended Apps

-

Pandora - Music & Podcasts

Pandora4.1

-

Pinterest

Pinterest4.5

-

YouTube

Google LLC4.1

-

ChatBot - AI Chat

X PhotoKit4.5

-

Hulu: Stream TV shows & movies

Disney4.5

-

TikTok

TikTok Pte. Ltd.4.4

-

Zoom - One Platform to Connect

zoom.us4.1

-

Poly.AI - Create AI Chat Bot

CLOUD WHALE INTERACTIVE TECHNOLOGY LLC.4

-

ChatGPT

OpenAI4.8

-

Spotify: Music and Podcasts

Spotify AB4.3

-

Yuka - Food & cosmetic scan

Yuka App4.7

-

Geeni

Merkury Innovations4.6

-

Netflix

Netflix, Inc.3.9

-

Passport Parking

Passport Labs, Inc.3.4

-

Waze Navigation & Live Traffic

Waze3.9

Disclaimer

1.Pocketapk does not represent any developer, nor is it the developer of any App or game.

2.Pocketapk provide custom reviews of Apps written by our own reviewers, and detailed information of these Apps, such as developer contacts, ratings and screenshots.

3. All trademarks, registered trademarks, product names and company names or logos appearing on the site are the property of their respective owners.

4.Pocketapk abides by the federal Digital Millennium Copyright Act (DMCA) by responding to notices of alleged infringement that complies with the DMCA and other applicable laws.

5.If you are the owner or copyright representative and want to delete your information, please contact us [email protected].

6.All the information on this website is strictly observed all the terms and conditions of Google Ads Advertising policies and Google Unwanted Software policy.

7.Pocketapk.com is an independent, information-only website which is 100% free to all the users.