About This App

-

Category

Finance

-

Installs

10M+

-

Content Rating

Everyone

-

Developer Email

-

Privacy Policy

https://wise.com/privacy-policy

Screenshots

Editor Reviews

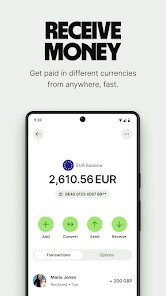

Wise, formerly known as TransferWise, is a financial app designed for sending money abroad and managing multiple currencies. It's essentially a digital account that lets you hold, convert, and spend money in different currencies, often at much better exchange rates than traditional banks. The service first launched back in 2011 and has grown massively since then. You can download the Wise app for free from both the Google Play Store and the Apple App Store. It has racked up tens of millions of installs globally. While the app itself is free to download and install, using it involves fees for currency conversion and transfers, which are always clearly shown upfront. You do need to register and verify your identity to use it, which is standard for any financial service. There are no annoying in-app ads, but there are optional paid features like the Wise debit card for spending your balances.

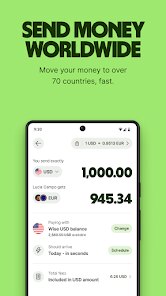

Using the app is pretty straightforward. You set up a transfer by entering the amount and choosing the recipient's country. The app instantly shows you the real exchange rate, the low fee, and exactly how much will arrive. A great tip is to set up "Balances" for currencies you use often, like USD or EUR. You can top these up when rates are good and then send from that balance later, potentially saving even more. You can also get local bank details in several countries, which is super handy for getting paid by clients overseas without them needing to do an international wire.

Compared to other options like using PayPal or a standard bank transfer, Wise is almost always cheaper for international payments. Banks often hide big fees in a poor exchange rate, while PayPal's consumer fees for currency conversion can be high. Other specialist apps like Revolut are similar, but I stick with Wise because its transparency is unmatched. From the moment you start a transfer, you know the exact cost. It feels built for people who move money regularly, not as an afterthought in a banking app. For straightforward, low-cost international transfers, it's hard to beat.

Features

- 💸 Real Exchange Rates: Wise uses the real mid-market exchange rate you see on Google, plus a small, transparent fee. Unlike banks or PayPal that add a markup to the rate, you see the true cost immediately, which often saves a significant amount on larger transfers.

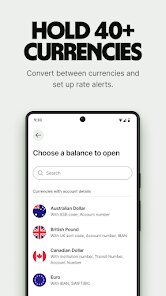

- 🌍 Multi-Currency Accounts: You can hold and manage money in dozens of currencies within the app. This feature lets you convert money when rates are favorable and send it later, or even receive payments like a local with dedicated account details for the US, UK, Eurozone, and more.

- 💳 Wise Debit Card: This optional card links directly to your Wise balances. You can spend in any currency at the real exchange rate, making it perfect for travel or online shopping abroad. It automatically deducts money from the correct currency balance, avoiding foreign transaction fees.

- ⚡ Speed and Tracking: Most transfers are fast, some even instant. The app provides clear tracking for every payment, so you're never left wondering where your money is—a level of detail most traditional banks don't offer for international wires.

Pros

- ✅ Transparent Pricing: The biggest strength. With Wise, there are no hidden charges. The fee is shown before you confirm, unlike many banks that surprise you with correspondent bank fees.

- ✅ Cost-Effective: For most international transfers, Wise is significantly cheaper than using a high-street bank or PayPal, especially for larger amounts or less common currencies.

- ✅ User-Friendly App: The interface is clean and intuitive, making a potentially complex process very simple. Managing balances and past transfers is easy.

Cons

- ⚠️ Not Ideal for Cash: Unlike Revolut, you can't top up your Wise account with cash at a store, which can be a limitation if you primarily deal in physical money.

- ⚠️ Transfer Limits & Holds: For security, there can be limits on transfer amounts, and occasionally funds are held for verification, which can delay urgent payments compared to some peer-to-peer methods.

- ⚠️ Complex Currency Needs: For advanced needs like stock trading or cryptocurrency, apps like Revolut offer more features within their paid plans. Wise is focused primarily on currency exchange and transfers.

Recommended Apps

-

Hulu: Stream TV shows & movies

Disney4.5

-

ChatBot - AI Chat

X PhotoKit4.5

-

Passport Parking

Passport Labs, Inc.3.4

-

Microsoft Teams

Microsoft Corporation4.6

-

Spotify: Music and Podcasts

Spotify AB4.3

-

Microsoft Copilot

Microsoft Corporation4.8

-

Zoom - One Platform to Connect

zoom.us4.1

-

Telegram

Telegram FZ-LLC4.2

-

Instagram

Instagram3.9

-

Grok

xAI4.9

-

GroupMe

GroupMe4.5

-

TikTok

TikTok Pte. Ltd.4.4

-

Google Chrome: Fast & Secure

Google LLC4.1

-

DoorDash - Food Delivery

DoorDash4.6

-

Geeni

Merkury Innovations4.6

Disclaimer

1.Pocketapk does not represent any developer, nor is it the developer of any App or game.

2.Pocketapk provide custom reviews of Apps written by our own reviewers, and detailed information of these Apps, such as developer contacts, ratings and screenshots.

3. All trademarks, registered trademarks, product names and company names or logos appearing on the site are the property of their respective owners.

4.Pocketapk abides by the federal Digital Millennium Copyright Act (DMCA) by responding to notices of alleged infringement that complies with the DMCA and other applicable laws.

5.If you are the owner or copyright representative and want to delete your information, please contact us [email protected].

6.All the information on this website is strictly observed all the terms and conditions of Google Ads Advertising policies and Google Unwanted Software policy.

7.Pocketapk.com is an independent, information-only website which is 100% free to all the users.